Ah, the debate of the century. Real estate investing vs. stocks; which is better? If you ever get into a conversation about making money and investments, a discussion around real estate investing vs. stocks will invariably come up. There will be a slew of people trying to convince you that real estate is better and another slew of people trying to convince you that the stock market is better.

One of my pet peeves is that these conversations always seem to focus on how much money one investment generates. Yes, money is essential; we invest money to make more money. But there isn’t nearly enough thinking about how that money is generated in your investment, the volatility of your asset, the skills you need to choose the suitable investments successfully, and how all these factors must be considered based on your unique position in life.

All investments have their ups and downs. Depending on your current stage in life and knowledge, some pros of one investment will matter way more than another, and you may be better suited to handle certain negatives of one investment than another.

And so, I decided to write this article to take a deeper dive into the topic of real estate investing vs. stocks to help you develop a stronger ability to critically analyze when particular investments are better than others.

Types of Real Estate Investments

Before diving into real estate vs. stocks, we must understand that there are different investment strategies within the real estate and stock market industries.

The sub-investment strategies are all significant topics of their own, with much to learn to become proficient. In this article, we won’t be going super in-depth on executing these investment strategies and will focus primarily on a basic understanding of each investment strategy.

With that out, let’s get into what kind of real estate investments are out there.

Single-Family Homes

Investing in single-family homes is the most common type of real estate investment strategy out there. When you see a house that looks like a good investment, you get a mortgage (or use cash) to buy the house and rent, renovate, and/or hold the home for yourself. If you’re renting the house out, you’ll get money from the tenants paying rent, and typically, the real estate’s value should go up over time which you can profit from when you resell.

Condos

Investing in condos is pretty much the same as investing in single-family homes, except you’re buying individual units in a building rather than a standalone. Most of the time, condos are cheaper because you generally don’t have as many rights as owning a standalone home, but rents tend to remain the same between single-family homes and condos.

This means condos are usually easier to buy, and you can often find deals where you’re making more money from rent, but they generally won’t appreciate as much as a single-family home over time.

Multi-Families

When investing in multi-families, you buy residential buildings with multiple units inside. Types of multi-family investments include duplexes, tri-plexes, fourplexes, townhomes, and entire apartment buildings. To be clear, investing in a multi-family means you’re buying the whole thing; not just half of a duplex or one condo within the apartment building. The model generally revolves around renting units in the building out for rent.

This investment strategy tends to generate the most incredible cash flow and has amazing appreciation rates. Cons? You’ll need a lot more money to get started as duplexes are often 50% more expensive than comparable single-family homes. Entire apartment buildings will generally set you back several million dollars.

Commercial Real Estate

Investing in commercial real estate is when you buy real estate designated for business uses such as office buildings, restaurants, retail stores, and malls. This model also revolves around renting spaces out for profits, but you’re leasing spaces to businesses instead of leasing spaces for living purposes.

Investing in commercial real estate is similar to multi-families because you’ll need a lot of capital to start. The difference is that potential profits could be higher as commercial leases are often much more expensive than renting space to individuals and families. Still, your earnings rely on the financial performance of the businesses you lease to. You’ll have to be savvy about which locations and buildings companies want to be in and what you can do to help the companies that rent your building succeed.

Industrial and Farmland

Industrial and farmland investments have the same concept as commercial real estate, except the skills you need to succeed are entirely different. Again, it’s about helping the businesses that rent your real estate succeed, but industrial and farmland investing will typically require much more technical knowledge.

Short-term and Vacation Rentals

Short-term and vacation rentals are another popular real estate investment strategy. People typically buy single-family homes or condos and use software like Airbnb to rent them out. Larger investors might look at luxury properties in unique locations, hotels, motels, and resorts.

The strategy here is focused on getting profits from rent, like most real estate investment strategies, but you’re generally getting more money at higher turnover rates which means typically more maintenance work.

Flipping and Development

I touched on flipping a little bit when I talked about how one can renovate a single-family home to raise its value. Flipping is an investment model where you buy real estate at below market values, renovate them to increase its value, and then sell them at a profit.

In addition to flipping, development is in the same category, or rather, flipping is one form of real estate development. Other real estate development strategies include buying land to build luxury homes, communities, apartment buildings, and office buildings. It’s typically a strategy where you take something undesirable, make it desirable, and take the profits.

This strategy is also very capital intensive, but when done right, it’s the fastest way to grow money in real estate. Development is also a strategy that’s often used with other real estate investment strategies for maximum profits.

Types of Stock Market Investments

Now when it comes to real estate investments, the list above is not an extensive list of all types of real estate investments. Within each investment type, there are often more niches one can go on and on about.

The same can be said for stocks. If any of these investments or something not covered in this article interest you, definitely let me know, and I can link you to more resources.

Individual Stocks

The primary investment strategy that comes to mind when thinking about the stock market is investing in individual stocks. This strategy is where you buy publicly traded shares of companies such as Apple, Google, Nike, Disney, and others. By purchasing the stock, you become a part-owner of the company and make money by selling your shares at a profit and sometimes through dividends.

Actively Managed Funds

Another popular way to enter the stock market is through actively managed funds. Examples of actively managed funds are mutual funds and hedge funds. When you’re buying into these funds, you’re essentially giving your money to someone else to choose various investments in hopes of a professional generating better returns than you can on your own. Involving a fund manager in your investment strategy will generally mean higher fees, more significant initial investments, and more rules on when you can move your money.

Options Trading and Day Trading

Options trading and day trading are other investing strategies related to the stock market. To be honest, I do not have much experience with options trading and day trading, so I recommend you check out more resources on these investment strategies if you’re interested.

But generally, these strategies are designed to generate large short-term profits with smart bets and come with the risk of losing more money than other stock investment strategies.

Exchange Traded Funds (ETFs)

Investing in exchange traded funds, or ETFs, are my favorite type of stock market investment. These are funds that are traded on stock exchanges like typical stocks. However, instead of buying into one company, you’re buying into everything included in the fund without the direct ownership rights of buying into one company.

Investing in ETFs is excellent for those who want instant diversification and/or want to invest in certain sectors without spending time and money balancing a portfolio for each company in the investor’s bullish industry.

Real Estate Investing vs. Stocks

Now for the juicy part. Real estate investing vs. stocks; which is better? Or rather, the question we should be asking is, what strategy works best in what situation? To answer that question, we need to know the pros and cons of both investment strategies.

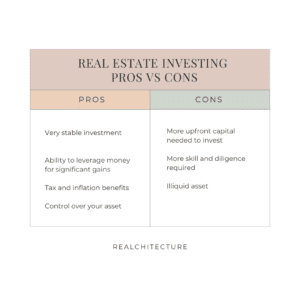

Real Estate Investing Pros and Cons

Pros:

1. Real estate is very stable

Real estate prices are generally very stable. A property worth $1M today is probably still worth about $1M tomorrow. And as long as you don’t make any significant non-value increasing improvements on a property and barring any disasters that make the land unusable, 10 years later, any property you buy should be worth more than what you bought it for.

2. Ability to leverage your money

Arguably, the greatest part about real estate investing is your ability to leverage your money. Let’s say you have $200k sitting in the bank and can take a mortgage for $800k. There’s a piece of real estate for sale at $1M.

You do your math and see that the property can rent for $12k in profit (earnings after subtracting all expenses like your mortgage payments, insurance costs, maintenance fees, and more) annually.

If you put a $200k down payment, take an $800k mortgage, and rent out your property to cover costs, in however long it takes to pay off your mortgage, you will have 5xed your money. That’s without considering the property’s appreciation in value and the rental profits you should be reaping.

In simpler terms, you’re spending $200k to get a $1M investment and getting a bonus 6% yield on the $200k ($200k divided by $12k). Leverage and real estate combined are how many “normal” people become wealthy.

3. Tax and inflation shelters

Another great part about real estate investing is that real estate is an excellent shelter for taxes and inflation. Tax rules will differ significantly depending on your citizen status and the country you invest in. In general, however, there are many tax write-offs for real estate that can put a lot of money back in your pocket.

Real estate also performs very well as a shelter for inflation. Your highest costs to own real estate, such as your mortgage and property taxes, typically don’t go up that much with inflation, while rents and the value of your home will rise with inflation. This makes real estate one of the greatest assets to own to counter inflation.

4. You can make improvements to the value of your real estate

Another great part about buying real estate is that you own a tangible asset that can be improved. For example, if you buy a house, you might be able to renovate it for a higher resell value and command higher rents and demand from renters. If you’re even savvier, you can also redevelop and rezone lots to turn something like a regular house into a duplex or multiple houses into a large apartment complex.

Cons:

1. More upfront capital required

The biggest con of real estate investing is the amount of money you need to get started. With most conventional loans requiring a 20% down payment, even buying a $100k condo will require $20k down. And depending on your market, an $100k condo might not even be realistic. Average detached home prices are around $600k in Calgary, with condos around $250k, and we’re one of the “most affordable” cities in Canada.

This means getting started in real estate often requires you to already have more than $50k sitting around, not to mention a stable income source to help you get qualified for a mortgage.

2. More skill and diligence are required in real estate investing

There are ways to get financing for zero money down, but it will require significantly more research and diligence. You can dive into the world of seller financing, B-tier lenders, and more, but be very careful and know what you can afford.

A significant risk of real estate compared to stocks is that most real estate investing is done with loans. One misstep could mean loan sharks coming after everything under your name.

Beyond mortgages, real estate investing will generally require more skill and care. Factors such as the condition of the properties you buy, landlord and tenant rights, and managing properties must be diligently considered.

I recommend spending a good six months to a year learning more about real estate investing and the real estate market you want to invest in before making any significant commitments.

3. Liquidity

Real estate being not a very liquid investment is another reason why real estate investing requires more extensive commitments. Selling a home takes time, and you generally can’t sell just a tiny part of the home. Between the time it takes to prepare a home for sale, find a buyer, and close on the property, you’re almost always looking at least 30 days or more.

For example, if you find yourself a few thousand dollars short of covering your monthly expenses one day, you can’t decide on a whim to sell a house in one day to cover those expenses. Nor can you sell just one part of the home to cover a few thousand dollars in costs.

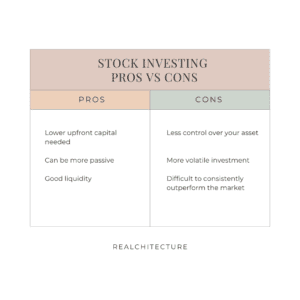

Stock Investing Pros and Cons

Pros:

1. Lower upfront capital required to get started

One of the biggest benefits of stock investing is that you don’t have to make a substantial financial commitment. You can get started with just a few hundred bucks. Use whatever savings to buy a couple of stocks and invest whenever you have spare change. As long as you’re not diving into margins and investing more than you can afford, stock investing can be a relatively stress-free experience.

2. Can be much more hands-off and passive

What I love most about stock investing is that it can be completely passive. One easy way to invest in the stock market that people such as Warren Buffett have been recommending is to choose a low-cost S&P500 index fund, put some money into it every month, and hold it forever.

It’s a straightforward strategy that’s hard to screw up. An S&P500 index ETF such as VOO or SPY (links to data on these ETFs) averages about 11% yearly return. That’s pretty good for an investment you can buy and forget about.

If you like picking your own stocks, you might like Peter Lynch’s (one of the best mutual fund managers of all time) approach to investing for the average person. You don’t have to constantly dig into companies’ finances and analyze securities on a technical level to perform decently as a stock investor.

By simply being aware of what businesses are performing well or becoming popular, chances are those companies will be decent stock investments. It’s not always the case, but if you buy multiple companies and diversify, the potential growth of one stock could cover many losses.

Let’s say you bought five stocks of different companies. Over the long run, one company may have gone bankrupt, the second company performed below average, the third company performed as you expected, the fourth company performed above expectations, and the fifth company heavily outperformed expectations. As long as you’re not playing with margins and shorting, you can only lose what you put in while your gains are potentially infinite.

Invest with logic, don’t get emotional, and your money will grow effortlessly.

3. Good liquidity

Another significant advantage of investing in the stock market is that your investments are often liquid. Unlike a real estate investment, if you lack $5k or so to cover this month’s expense, you can sell $5k worth of stocks in your $800k portfolio often within a day, depending on what you invested in.

Cons:

1. Less control over your asset

One of the cons of investing in the stock market is that you have less control over your asset. If you don’t have the majority share ownership position in the companies you invest in, you can’t really control any day-to-day operations. It isn’t easy to do anything significantly affecting the share price, so your investments are often made based on trust in the company and its people.

2. More volatile investment

Stocks being a more volatile investment is also something to take note of. For day traders and short-term investors, volatility is a good thing. But for those who are looking to invest long term and are people who get emotionally affected watching their stock portfolio change in value every day, the stock market’s volatility is a definite con.

Even the largest companies can completely vanish, and that fear is enough to stop many from getting into the stock market.

3. Difficult to consistently outperform the market

This may be a little controversial, but I’ll say it right here and then. Real estate outperforms stocks as an investment due to your ability to leverage your money and have other people pay your mortgages via rent.

It is difficult to outperform the stock market consistently. Even the best fund managers and professionals can only do it sometimes. That’s why so many people recommend the strategy of buying an index fund to match the market’s returns.

Yes, certain stocks will flip upwards rapidly in a very short time. For the same amount of success stories, there are often many more failures, so the overall returns of the stock market average out. By following the market, you’ll see an average return of about 11% over the years, according to Investopedia. It’s great for those who want to grow their money without much thought, but it’s not that good for those thinking of flipping their money multiple times.

Real Estate Stock Investment Hybrids

So now that you know some of the various investment strategies and the pros and cons of real estate investing vs. stocks, I would like to introduce another topic I had purposely left out earlier.

We often debate whether stocks or real estate are the better investment, but there are also types of investments that combine stocks and real estate.

Real Estate Investment Trusts (REITs)

Real Estate Investment Trusts, or REITs, are similar to hedge funds and mutual funds, except the investments within a REIT are primarily concentrated on real estate. REITs work by calling investors to pool their money into the fund, in which the “fund manager” will then go out, buy real estate, collect rent, and redistribute the rental income out to the investors.

Buying Real Estate Companies

Another way to invest in real estate through the stock market is by buying companies in the real estate industry. If you like where the real estate industry is going but don’t have the money to purchase properties themselves, you can technically own bits of real estate by holding the companies that own the real estate.

For REITs and buying real estate companies, you are essentially trying to get exposure to the real estate sector but reap the pros and cons of stock investing. Again, this is not an objectively better investing strategy but will work well for certain people in certain situations.

Different Investments For Different People

If you haven’t gotten the memo yet, real estate investing is not objectively better than stock investing, nor is stock investing better than real estate investing. They are different investments that will suit different people in different situations.

For those who have quite a bit of money on hand, are interested in growing their wealth rapidly and consistently, and have the willingness to get more hands-on with their investment, real estate is a phenomenal option.

For those who want a more passive investment where they don’t have to invest tons of time and money, investing in the stock market will generally be a better option.

Real Estate Investing vs. Stocks, Why Not Both?

Why not try both if you’re indecisive about whether to go forward with real estate investing vs. stocks?

I deal with many high-net-worth individuals in the luxury real estate auction world. Many of them hold money in both real estate and the stock market, as splitting your eggs up in multiple baskets is always a good move.

And yes, for those of us who may not have millions of dollars to invest, that limitation often forces us to choose one or the other.

If you don’t know much about either real estate or stock investing, I recommend starting with stocks. Let your money sit in stocks so that you eventually have enough money to do both real estate and stock investing. Use the time when your money is in the stock market to get really knowledgeable about real estate and/or stock investing.

Once you have more money, you’ll also have a good idea of what will be a good investment. You may also find out that you prefer one investment vehicle over the other.

And that’s okay. There is no clear winner when it comes to the debate of real estate investing vs. stocks. Because at the end of the day, both investment vehicles create wealth when done right, and that’s what matters most.