There has been a ton of news coverage around rising interest rates in the summer months of 2022. Banks in Canada and the US have raised interest rates quite a bit, affecting people everywhere with a substantial impact on the housing market.

In this article, I will go through basic ideas on how rising interest rates affect the housing market and its consumer to give you a foundational understanding of the interest rates and the economy as it relates to real estate.

Why Governments Raise Interest Rates

Ever since the Great Depression, governments worldwide have realized that a fully-capitalist society produces extremely volatile economies. When leaving our economies to go to work without government intervention, we’ll often see unprecedented growth followed by hard-hitting recessions.

While this volatility is necessary and unavoidable, an extremely volatile economy has severe consequences for people. Imagine being one of the wealthiest people in the world one day and declaring bankruptcy the next. And beyond those playing the market, companies and people not having as much money as they once had means they’re often cutting spending.

That means companies letting go of employees, which leads to those employees spending less, which leads to more businesses letting go of their employees. You can see how this can quickly lead to many companies shutting down and the unemployment rate rising.

Now, what does this have to do with interest rates?

Most of us can agree that we want a stable, growing economy. An economy growing at extreme speeds tends to come with the side effect of consumer products getting too expensive too fast. The faster and bigger an economy gets, the economy will typically fall with the same speed and scale.

One tool governments use to help curve our economies’ growth rates is by controlling interest rates. Governments will raise interest rates to avoid an economy growing too fast. To prevent an economy that’s stagnating, governments will lower interest rates.

Controlling interest rates affects the accessibility of money. When money is abundant, people tend to spend more. That means more profits for businesses and, in turn, more money for workers. When money is limited, people spend less.

Raising interest rates makes it more challenging to get money by making borrowing more expensive. This causes people to slow down on spending, which will help slow down the economy. My mother, for example, owns multiple rental properties. Rising interest rates mean higher monthly mortgage payments, which means less money in her pocket to buy other things. Imagine my mother on the scale of millions of people. Lowering interest rates does the opposite.

What Typically Happens To the Housing Market In a Higher Interest Environment

Now that we understand governments raise interest rates to curb how fast our economies are growing to avoid large-scale economic depressions, how does the higher interest rate affect housing markets worldwide?

As I may have alluded to earlier with my mother, most homes are bought with a mortgage. In a higher interest environment, mortgages are more expensive as a higher interest rate means higher monthly payments not everybody can afford.

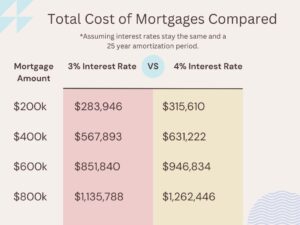

For context, take a look at the chart below showing how different interest rates affect a person’s ability to buy a home:

As you can see, a 1% difference in interest rate can mean a difference of $30k to more than $100k. There are more nuances and specifics that affect each circumstance. Still, you can see how a change in interest rate can make mortgages unaffordable or at least unattractive to take out.

Thus, home sales and prices typically fall when interest rates go up. Higher interest rates mean we’re generally shifting to a buyer’s market in real estate. In this market scenario, homes will typically take longer to sell, buyers have the freedom to put more conditions on their offers, and generally, there will be more negotiations.

The Resulting Effect On Various Homebuyers and Homeowners

Rising interest rates create an environment where real estate prices drop and sales slow down. What does this mean for its various consumers?

Sellers

For sellers, or people looking to sell their homes potentially, the impact is pretty obvious. Your home will take longer to sell, and you might not get the price you hoped to get. If you don’t need to sell your home, it would be advisable to wait until market conditions improve.

Must-Buy Homebuyers

With all the news about the market cooling down, there has been a lot of excitement about real estate prices dropping for buyers. Unfortunately, not all buyers benefit. The majority of them don’t benefit much.

As discussed in this article, the recent cooling housing market was primarily a result of rising interest rates. The chart above shows that a 1% interest rate difference can make taking a mortgage significantly more expensive. This increases the cost of borrowing, leaving most homebuyers in a situation where they’re borrowing, leading to them paying less for homes, hence a drop in prices.

For the must-buy homebuyers, which I describe as homebuyers who need to buy due to some factor such as job relocation as those who typically use traditional mortgages to buy homes, they’re not significantly impacted. Yes, getting a loan is more expensive now, but you’ll be pleased to see that the market is dropping simultaneously. Your cost to own a home is going to be pretty much the same as before.

All-in-all, must-buy homebuyers come out better as well since a cooling market means less competition. That means more time to do due diligence, search for homes, and make well-educated offers to get a great deal.

Nonetheless, there are a large number of homebuyers who don’t realize this situation and will rent due to the fear caused by the media. It’s not really more expensive for homebuyers as home prices are dropping simultaneously, but there is enough doubt to cause many to choose to buy later.

Existing Homeowners

Existing homeowners are one of the groups most affected by rising interest rates. If you recently became a homeowner and locked in a fantastic pandemic rate, you will be super happy that you made that decision.

Homeowners who went for variable mortgages or just so happen to be in a situation where they need to renew their mortgages will struggle a little or a lot, depending on their financial positions. For example, a person who has their home nearly all paid off won’t care as much as someone in their first few years of home ownership.

Small-scale investors, which are investors who own 1-5 properties and are usually in highly leveraged positions to buy properties, are also suffering. Again, depending on what type of mortgages the investors got, the rise in interest rates could completely destroy their financials and force them to sell their properties.

Cash Buyers and Large-Scale Investors

“Be fearful when others are greedy, and greedy when others are fearful.” – Warren Buffett.

While Warren Buffett was talking about the stock market, that quote also applies to the housing market. However, there are more nuances when it comes to the housing market.

Since homes are way more capital-intensive investments than stocks, fewer people can take advantage of being greedy when others are fearful. The average working person needs to use traditional financing to buy a house, and the whole premise of this article is that conventional financing has become much more expensive.

However, the people who can take advantage of dropping house prices are cash buyers and large-scale investors.

People who buy homes all or majority with cash don’t need to worry about rising interest rates much. For these people, the price drops are real. A house that was $800k a year ago could be $750k now, and it’s entirely possible that a cash buyer had $800k a year ago and still has the same amount today.

Additionally, I’ve included “large-scale” investors in this section as they’re usually high-net-worth individuals who can get very creative with financing.

A savvy investor may use equity to raise capital to invest in homes in the same way fund managers convince people to give them money to manage.

“The rental market is still strong, but home prices are down. We can invest in certain properties in this market to achieve a 10% ROI. I’ll handle all the property management. You just need to help fund this venture.”

Depending on how solid the guy’s track record and business plan are, I can definitely see someone pitching his high-net-worth friends to give him a couple of million dollars to invest in homes.

How Rising Interest Rates Affect the Housing Market Conclusion

In short, rising interest rates lowers the affordability of mortgages leading to buyers’ being unable to pay as much as they could. before to buy a home. This causes home prices to drop and sales to slow down. One should not worry too much though as the housing market drop isn’t that big compared to what we could have in a zero-interest, unregulated environment.